As a financial advisor, your success depends on building trust, staying memorable, and making it easy for clients and prospects to reach you. But traditional business cards, once a staple in your toolkit, fall short in today’s fast-paced, digital-first world. They get misplaced, offer limited space, and fail to make a lasting impression.

That’s where digital business cards come in. These modern alternatives go beyond just sharing contact details; they help you establish credibility, stay top-of-mind, and make follow-ups effortless.

Let’s explore how digital business cards work and why they’re the more intelligent choice for financial advisors who want to stand out and grow their client base.

Table of contents

- 6 challenges financial advisors face (& how digital business cards can solve them)

- Digital business cards for financial advisors: Best practices

- Unlock the power of digital business cards for your financial practice

- Frequently asked questions

6 Challenges financial advisors face (& how digital business cards can solve them)

Let’s examine the main issues they face and how digital business cards can solve them:

1. Paper cards often reach the trashcan, risking your financial business

According to a UK-based press, 10 billion paper business cards are printed annually, of which 88% are in the trashcan within a week!

As a financial advisor, you should be able to relate: how many of the dozens of paper cards you receive are handy when you need them?

The same applies to your prospects. They, too, will find looking for your card among a pile of other cards challenging. Your card often becomes another piece of paper stuffed in their wallets or scattered on desks.

Furthermore, physical business cards are limited to in-person interactions—which may not always be convenient. This means you can’t exchange information at virtual events and video conferences.

🛜 How digital business cards can help

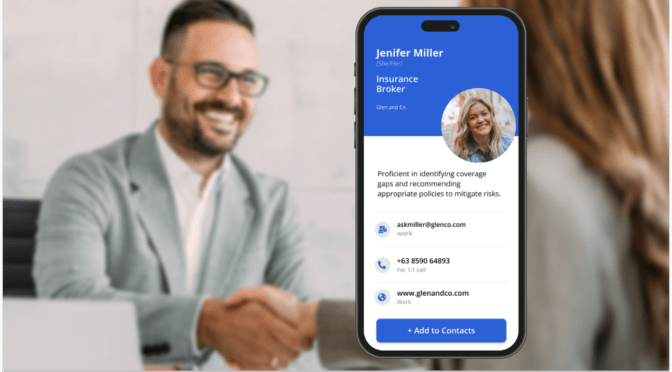

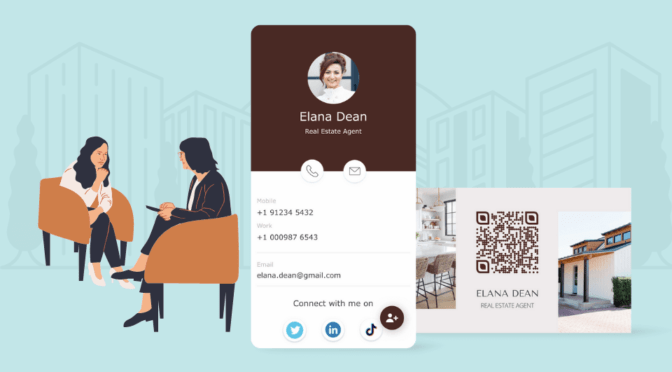

- Keep your digital business cards handy on your mobile device as a QR Code or URL or as Apple Wallet or Google Wallet passes–and easily share.

- Every digital business card has an “Add to Contacts” button, making saving information on mobile devices easy.

- Exchange data instantly, such as contact information and other resources—without you or your prospect downloading an app.

- Embed card QR Code in your Zoom background or presentation files to make it easier for prospects to access your contact information.

2. No space on the card to fully convey your financial expertise

As a financial advisor, you offer various services, including budgeting, debt management plans, tax planning, and more. However, fitting all the details on a small physical business card is impossible. Paper cards can only accommodate contact details, leaving little room to showcase your capabilities.

The limited space to put all your details often makes it difficult to make an impression on prospects and stand out in a crowded market. Prospects may not understand the depth of your offerings, leading to missed opportunities. Just so you know, 72% of people judge your company by your card.

🛜 How digital business cards can help

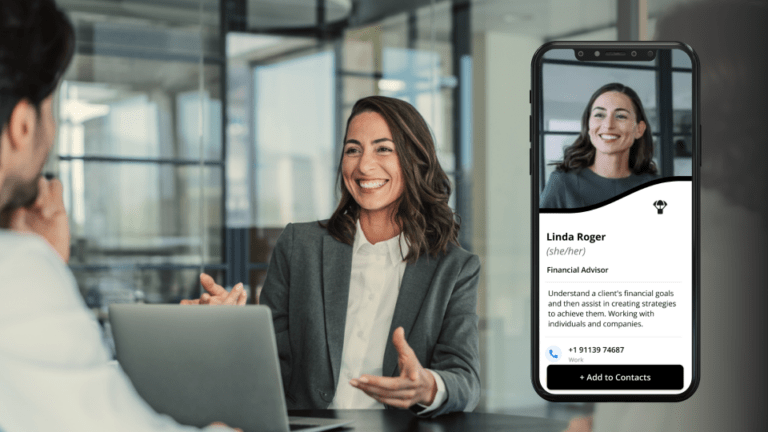

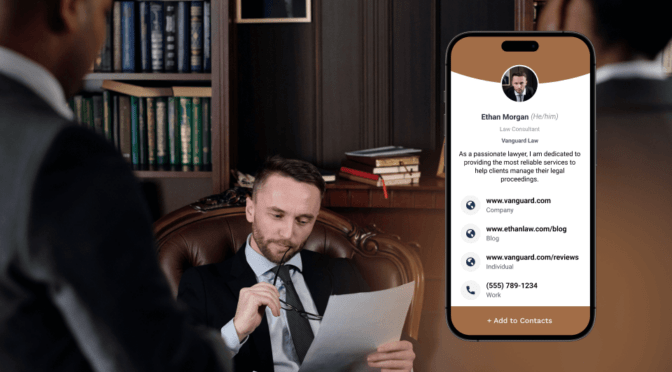

- There’s enough space to add a bio, professional headshot, and company logo to highlight your experience, certifications, and credibility.

- You can directly link it to your personal or company website, portfolio, and testimonials, which prospects can access.

- You can include engaging videos explaining your services or downloadable brochures outlining your fee structures.

3. Outdated information on printable cards

Printed cards quickly become outdated with changes in phone numbers, email addresses, or even your service offerings. This reflects poorly and can damage your credibility in the eyes of prospects.

Maintaining an accurate supply of physical cards requires constant monitoring and frequent reprints. It is also expensive and time-consuming.

🛜 How digital business cards can help

- You can easily edit and update your digital business cards to ensure prospects can access accurate and up-to-date information.

- Edit without incurring printing costs and incorporate frequent updates using the backend.

- Update or modify the entire team’s information on the digital business card through a centralized platform you utilize.

4. Bridging the gap between gathering & organizing data

Gathering and organizing prospects’ data will be tricky if you use physical business cards to exchange contacts.

For instance, after collecting paper cards, you must manually transcribe contact information into CRM software. This process tends to be tedious and prone to human error.

Think of the lag between receiving a physical business card and entering the lead data into the CRM system, which can result in delayed follow-up with prospects, reducing the effectiveness of lead nurturing efforts.

Additionally, client data scattered across various sources, such as paper files, email inboxes, and spreadsheets, makes maintaining a centralized and up-to-date database challenging.

🛜 How digital business cards can help

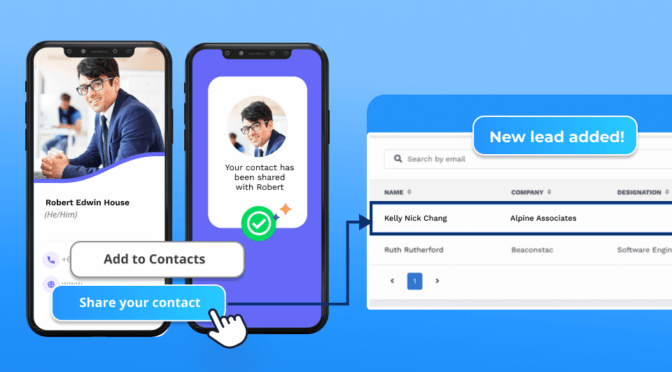

- Automated digital business cards eliminate tedious data entry tasks, freeing valuable time to build personalized connections with prospects.

- Utilize two-way contact sharing and capture prospect information using the same e-business card.

- Since your contacts are on the CRM automatically, schedule personalized emails or reminders for future touchpoints for consistent communication.

⚡Pro tip: Consolidate client data with Uniqode’s digital address book and integrate your digital business cards with many CRMs.

- Store contacts you receive via your digital business cards in the Contact Manager in your Uniqode account.

- View, edit, and delete contacts as needed, ensuring their client database remains organized and up-to-date.

- Natively integrate the address book with CRM such as Salesforce to streamline contact management and lead nurturing processes.

- Export contacts to CRMs such as HubSpot or Pipedrive via Zapier integration and simplify data organization.

- Connect Uniqode digital business cards with Microsoft Entra ID (Azure AD) via API to simplify team member onboarding and off-boarding.

5. Inability to track, segment, and understand prospects

When you give your prospect a physical business card, interaction with them typically ends there. This is because there is no guarantee that they will retain your card. This one-way exchange makes it difficult to collect their information for future contact.

Further, it can be tough to track interactions. You might struggle to differentiate between warm leads (interested or engaged clients) and cold leads (clients needing more nurturing).

Additionally, physical business cards offer limited avenues for communication. Prospects may prefer alternative communication channels such as social media or messaging apps. But physical cards can’t accommodate clickable links.

🛜 How digital business cards can help

- You can set the fields in your digital business card based on the data you want to collect.

- You can then segment them based on engagement levels. This can help you identify warm leads and reach out accordingly.

⚡Pro tip: Get a bird’s-eye-view of how prospects engage with your digital business card with data analytics.

- Get the following data from your cards:

- Card view: Learn how effective your distribution strategies and promotional efforts are.

- Contact saves: Identify warm leads who are actively interested in your service.

- Unique users: Assess the breadth of your client base to target your outreach efforts more effectively.

- Card views by device: Understand the effectiveness of your optimization for different platforms or screen sizes.

- Card views by time: Strategically schedule follow-ups or communication campaigns.

- Card views by city: Tailor your communication strategies based on geographical location.

- Card views by location: Get granular insights into audience demographics and preferences.

6. Navigating the minefield of data security

The financial industry is a prime target for hackers, and that includes its employees. While a paper business card might not seem like a big risk, losing one could hand over just enough information (your name, company, contact details) to fuel a phishing attempt or social engineering scam.

Plus, financial advisors are subject to strict regulations to protect client information. Misplacing a card with sensitive details could technically count as a data breach in some regions; not great for compliance or client trust.

At the very least, it’s a reputational risk. Beyond business cards, staying compliant also means using transaction monitoring to detect suspicious activity. It’s all part of protecting both your clients and yourself from fraud.

🛜 How digital business cards can help

- Any information on a digital business card is safeguarded via encryption if the provider supports it.

- You can implement access control measures such as password protection or multi-factor authentication to ensure that only authorized individuals can view the digital business card.

⚡Pro tip: Safeguard your data from security breaches and become compliant with data security laws with Uniqode.

- Implement phishing URL detection and disable any digital business card connected to a phishing URL to bolster your data security.

- Enable Single Sign-On (SSO) for your team. This will allow employees to log in once via one set of credentials, reducing incidents of password leaks or identity theft.

- Leverage our digital business cards that are SOC 2 Type 1 and Type 2 certified and GDPR compliant.

Digital business cards for financial advisors: Best practices

You can incorporate several elements into your digital business card to enhance engagement and maximize lead generation. Here they are

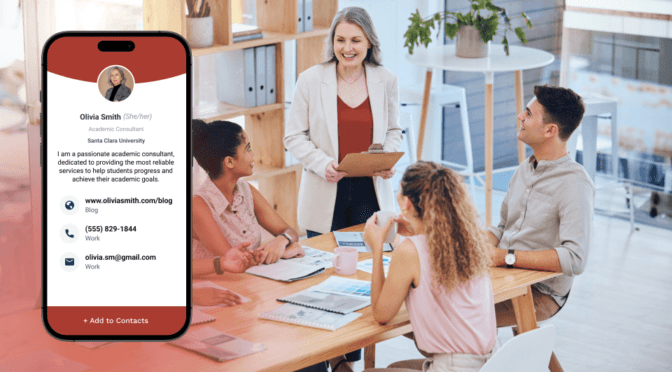

1. Captivate prospects with multimedia in your card

- Add videos explaining your services and how you solve important customer pain points. Include a short (30–60 second) intro video to introduce yourself and your value proposition.

- Share client testimonials or success stories to build trust quickly.

- Use charts, infographics, or short explainers to simplify complex topics such as retirement planning or portfolio diversification.

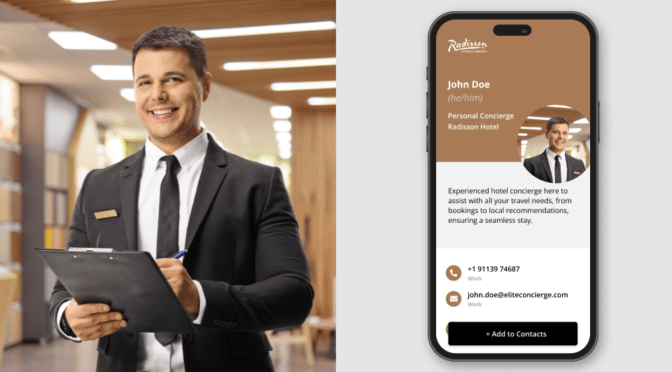

2. Stand out among the crowd with branding

- Include your logo, brand colors, and fonts. Add a professional headshot to make the card feel personal and credible.

- Avoid financial jargon. Use everyday language to explain your services—think “retirement plan review” instead of “portfolio rebalancing evaluation.”

- Test your card on friends or peers to see if your messaging feels human and approachable.

3. Keep an eye on analytics & track your growth

- Track how many people view your card, save your contact, or click your links using Uniqode’s analytics dashboard.

- If you notice certain CTAs or pages aren’t getting clicks, update your card with new messaging or placement.

- Set a monthly reminder to review your analytics and test small changes—such as a new CTA or video thumbnail.

4. A clear Call-to-action (CTA) is a must

- Tell people exactly what to do next—whether it’s “Book a free consultation,” “Download our planning checklist,” or “Connect on LinkedIn.”

- Limit to 1–2 CTAs per card to avoid overwhelming the viewer.

- Use first-person language like “Schedule my free call” to make your CTA feel more personal.

5. Reach more prospects with multi-language cards

For example, sharing your card in Japanese when targeting prospects in Tokyo shows your dedication to connecting on a personal level. This helps establish trust early in the relationship.

- Even a short greeting or tagline in the prospect’s native language can create an instant connection.

- Hire a native speaker or use a professional translation service to ensure tone and accuracy.

For example, sharing your card in Japanese when targeting prospects in Tokyo shows your dedication to connecting on a personal level. This helps establish trust early in the relationship.

⚡Pro tip: Speak your prospect’s language—literally—with Uniqode’s multi-language digital business cards.

- Instantly connect with global audiences in their preferred language

- Make your information accessible and easy to understand

- Build trust and boost engagement across diverse markets

- Enhance user experience with personalized, language-friendly interactions

6. Stay fresh, stay relevant, update

- Make it a habit to refresh your card with new titles, updated services, or seasonal offers.

- Link your card to a calendar, portfolio, or scheduling app to keep everything in one place.

- Set a quarterly check-in to review and update your card. Outdated info = lost trust.

Unlock the power of digital business cards for your financial practice

Traditional business cards can’t compete with the dynamic capabilities of digital business cards. They limit you to static information and get misplaced in the shuffle of networking events.

Digital business cards, on the other hand, offer a wealth of benefits, from showcasing your services in detail to engaging prospects with features like downloadable brochures. They also keep your information updated and accurate and provide a cost-effective and environmentally friendly way to exchange contact information.

Ready to transform the way you connect with clients? Uniqode’s digital business cards offer everything you need to create a dynamic, professional digital presence.

Frequently asked questions

1. What should financial advisors look for in a digital business card solution?

If you’re looking for a digital business card, finding one that is easy to use and effective is important. Solutions like Uniqode (formerly Baconstac) offer a range of features you can consider. Some notable ones are as follows:

- Customization: Choose a platform that allows you to personalize your digital card with your branding, contact information, and multimedia content.

- Compatibility: Ensure the platform works on various devices and operating systems so it’s easy to share and view your digital card. Uniqode, for example, is compatible with all Apple and Android devices.

- Analytics: Choose a service that provides analytics to monitor engagement and determine the effectiveness of your digital card.

- Integration: Find a platform that integrates with CRM systems to simplify data management and lead follow-up.

2. What key challenges do financial advisors face?

Financial advisors encounter several challenges in their profession, including:

- Limited reach and accessibility in networking.

- Difficulty in maintaining regular communication with clients.

- Displaying comprehensive information on traditional business cards.

- Keeping printed cards updated with accurate information.

- Integrating client data effectively with CRM systems.

- Building trust and professionalism in client interactions.

- Identifying and connecting with ideal prospects efficiently.

- Managing client data efficiently and securely.

3. Are digital business cards secure?

Digital business cards can be secure if used correctly. Most reliable platforms offer digital business cards and use encryption protocols to protect user data during transmission and storage. Users can also control the privacy settings of their digital cards, deciding who has access to their contact information. Choosing a reputable provider with a good track record of prioritizing data security is important.

4. How much do digital business cards cost?

Digital business cards can vary in cost depending on the provider and the features offered. Some platforms provide basic plans with limited features for free, while others offer premium plans with advanced customization options, analytics, and integration capabilities for a subscription fee. There may also be one-time setup fees or additional charges for services such as CRM integration or custom branding. It’s wise to research different providers and compare prices to find the most suitable plan that meets your needs and budget.

Sukanya is a Content Marketer at Uniqode and a former journalist who fuses newsroom curiosity with SEO-savvy storytelling to help brands grow online. She’s on a mission to demystify digital business cards, digging deep into data, trends, and user behavior to spotlight how they transform how we network and generate leads. Her content doesn’t just inform—it equips. Outside the digital realm, she’s either rescuing animals, getting lost in a plot twist, whipping up kitchen experiments, or chasing stories worth telling.